WWIII Has Begun: Part I

What’s Russia’s and China’s endgame?

Upend the world order where the United States is no longer on top. This is something Russia and China have spent the last 10+ years preparing for. The invasion of Ukraine is the first major step/escalation in a long arduous road ahead.

How do they plan to upend the world order?

By destroying the U.S. economy and/or the dollar by taking the price of oil and other commodities through the roof. Russian Minister said today that Russia is working on “One World One Currency” that would supplant the U.S. dollar. (The dollar has enjoyed exorbitant privilege at the expense of other countries and the US’ own manufacturing base and it should be taken out.)

What’s going on now?

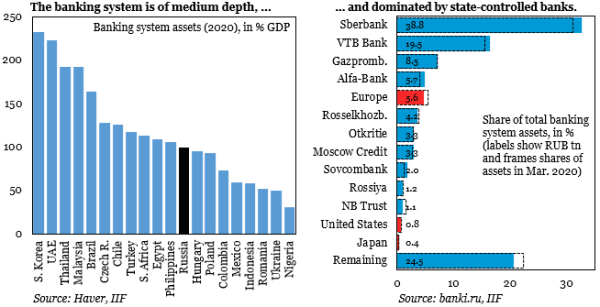

Many countries are removing some of Russia’s biggest banks from SWIFT (including Sberbank, where roughly half of Russians have an account), while others are considering sanctions on its central bank, which the IIF said would likely lead to disastrous bank runs and dollarization with a sharp sell-off on Russian foreign reserves and possibly a full-on collapse of its financial system. And some have argued that sanctioning Russia’s energy exports (which the West needs to do if it really wants to hurt Russia) would lead to hyperinflation, production shutdown, severe food rationing, widespread unemployment, and mass exodus from the country. Considering Russia is the world’s 11th largest economy and one in which the EU highly depends for its energy and commodity needs, I am inspired to see leaders in the EU act with decisiveness (particularly France and Germany) to uphold the democratic order, even if that means a hit to their economies.

However, Russia does have some cushions in place. It has accumulated $600 billion in reserves over the past decade or so specifically for this moment, with about 6.5% of those reserves in the U.S. dollar. The U.S. is trying to choke off these reserves, as the Treasury announced this morning. In effect, the U.S. just told the world that if we don’t like what you’re doing, even if for nefarious purposes, we’re going to prevent you from accessing your money (like Canada did with truckers).

Of course, after planning for 10 years, this is absolutely of no surprise to Russia nor China. Hence why Russia had developed its own internal equivalent of SWIFT in anticipation of this, which the Governor of the Russian Central Bank made clear it would use, if necessary. In addition, Russia has started to employ digital currencies to sidestep some of the sanctions. All of this doesn’t look good for the dollar long-term, particularly as more countries like India, Iran, Brazil, and China join forces to take down the U.S. dollar hegemony. Indeed, that is the group’s long-term goal. Ukraine is simply one of the first steps in a long game of chess. Russia also hopes the U.S. blinks first. And we very well might since we do not have the mission nor the resolve that Russia and China have: Will Americans tolerate $6 gas at the pumps and 25-50% higher food prices while unemployment spikes for a war we’re unfamiliar with? I don’t think so.

As the economic ramifications of this are felt across the globe, the Federal Reserve will have to choose between two poisons (as I’ve alluded to here) that have been a part of Russia’s and China’s game plan all along: (1) hike interest rates to bring down inflation and likely send the economy into another major recession (this is the destroy the U.S. economy scenario), or (2) let inflation run (this is the destroy the U.S. dollar scenario) and pray to God that that doesn’t take us towards a deflationary bust (and major recession) and sow deeper political discord at home (think: a sustained resurgence of Trumpism).