Ban Oil to Stop Putin?

On the one hand, as I mentioned in my previous post, the US needs to ban Russian oil in order to really hurt Putin — $10 in oil prices translates to $20 billion of revenue for Russia (or over $200 billion a year), according to the IIF. US and EU allies are in serious talks about an oil ban as I write this. A couple of days ago in the Financial Times, Pioneer CEO summed up my thoughts on the matter:

The only way to stop Putin is to ban oil and gas exports… [But] if the western world announced that we’re going to ban Russian oil and gas, oil is going to go to $200 a barrel, probably — $150 to $200 easy.”

But banning Russian energy doesn’t come without grave consequences for the US. As one famous Credit Suisse analyst said:

If you believe that the West can craft sanctions that maximize pain for Russia, while minimizing financial stability risks in the West, you could also believe in unicorns.

In the US, gas prices are already in the $3-5 per gallon range, with the national average now above $4 per gallon for the first time since 2008 — and that’s with crude at only $100 per barrel. Some places in Europe are seeing $9 gasoline prices, all a reflection of tighter oil supply across the globe. Expensive oil has consequences:

German Economy Minister: "A shortage in energy supply could threaten social cohesion in Germany.”

Bank of America: Sustained $100 oil would see a 2% hit to GDP.

Business Intelligence: A one-cent change in gas prices influences annual US consumer spending on fuel by about $1.1 billion, meaning that gas prices are effectively levying a $100 billion tax on consumers and dampening global consumption.

Given that the US is a 70% consumption-driven economy, this doesn’t bode well. Bond markets are now pricing a recession within 12 months. Atlanta Fed is predicting Q1 2022 GDP to be at 0%. Chances of a recession is looking likely at this point. Historical norms also suggest that we’re headed that way, considering we have entered recessions whenever oil prices have hovered around $100 a barrel, going all the way back to 1970. $150-200 oil is another story altogether.

In addition to higher oil prices, natural gas prices are spiking in Europe. Europeans are paying 9 times what we’re paying for natural gas. Yikes! And it doesn’t look like it’s going to get any better anytime soon.

EU import of Russian gas has been going up, and the war is only getting started. Russia’s natural gas windfall is currently $720 million per day. And that figure is before today’s (Mar 7, 2022) natural gas price spike up to 75% (yes, in one day).

Meanwhile, the Treasury has managed to freeze the majority of Russia’s $600+ billion in reserves. In response, Russia has asked fertilizer producers in the country to halt exports, which will cause further disruptions in crop yields, exacerbating the 20% year-on-year increase in food costs in February. The price of corn, soybean, and wheat as a group has climbed 20% over the past 2 weeks. There’s a broad-based increase in commodity prices. The situation is so dire that Xi Jinping is urging grain security, just as he has been accumulating commodities for the past decade, with China now owning the vast majority of the world’s supply — imagine the weaponization of food for global power, which is coming up soon!

So, we have pretty broad-based inflation.

As a quick aside: Was it coincidence that Putin decided to invade Ukraine now? Absolutely not, especially if he wanted to accelerate inflation, which he did. The timing was part of an economic calculus. And for the most part, things are going to plan for Putin to upend the dollar as the global reserve currency by 2030. Was it coincidence that the Fed Chair alluded to the multi-reserve currency basket in a testimony to Congress this past week, a testimony that was supposed to be about domestic monetary policy? I don’t think so.

Anyway, back to the war in front of us:

We’re also dealing with an overall precarious economic and political situation and a steadfast and defiant Putin. Zelensky said today, "The audacity of the aggressor is a clear signal for the West that the imposed sanctions aren’t enough." Interesting. If the West doesn’t impose tough sanctions, we’d essentially be giving the green light to Putin to take over any territory he wishes, like he did with annexing Crimea. If we do impose tough sanctions and escalate, he doubles down. I can only see one outcome. As Lithuanian President warned, “Putin will not stop in Ukraine.” The man has been planning this for 20 years. Among other scholars, Fiona Hill believes Putin is willing to use nukes. I think he’s willing to go the distance to get what he wants, even if that means nuclear war.

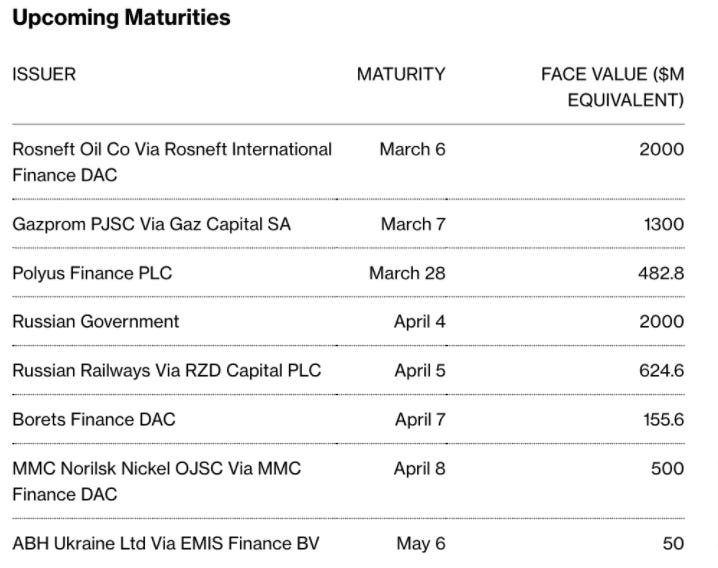

Meanwhile, Russian troops are poised to seize the capital of Ukraine in the next few days. Over one million Ukrainian refugees have fled the country. Much of Europe was almost wiped out in a near-nuclear accident(?) a couple of days ago (when Russian troops fired at a nuclear power plant). Major credit card companies have cut services in Russia, and Russian banks are moving to China’s card system, while the Chinese Foreign Minister proclaims how “rock solid” China’s relationship is with Russia and that prospects for cooperation between the two countries are extensive. Russia plans to disconnect from “external Internet” starting March 11, and all companies have 5 days to move to a Russian domestic server — are cyberattacks on the US coming?? Putin has threatened to pay debt in rubles, demonstrating further defiance in the face of sanctions, all within the backdrop of a potential sovereign bond default on the horizon.

So yes, an oil ban will hurt Putin but at great financial cost to Europe and the US, and it would take place during a fragile economic and political moment. Regardless of whether or not a ban is imposed, I doubt Putin will stop until he gets what he wants.